20+ mortgage charge off

Web Some creditors will accept as little as 10-20 of the remaining balance to settle the debt. Web A charge-off of a mortgage account occurs when a creditor has determined after multiple attempts to collect on the debt.

How To Pay Off Your Mortgage Faster Mortgages Cibc

Web 20-year Mortgage Costs The current average interest rate for a 20-year fixed-rate mortgage is 686.

. You should get it automatically within 20 days of paying off. Though you might be liable to pay taxes on any forgiven amount. If after investigating you find that the charge-off on your reports is legitimate its important to take action and pay it off.

Web Web If you want to pay off a mortgage faster than 30 years then a 20-year mortgage might be a good option. As a result the lender has some legal rights on your property as you pay off your mortgage. Web A charge-off of a mortgage account occurs when a creditor has determined that there is little or no likelihood that the mortgage debt will be collected.

My current score is around 585 and I have no other debt. This holds true even after the property is taken away from you via foreclosure and the foreclosure is finalized and sold. Web If the charge-off is legitimate.

Most mortgage charge off accounts are second mortgages andor HELOC Bank feels there is little or no chance or likelihood that the mortgage loan debt will be collected by the borrower. There is only room for improvement. A charge-off is typically reported after an account reaches a certain delinquency status and is identified on the credit report with a manner of payment MOP code of 9.

It may be tempting to not pay a charge-off since your lender. If the borrowers make a down payment of less than 20 they will be required to pay private mortgage insurance PMI. Web Mortgage Charge-Off A charge-off occurs when a lender writes off unpaid debt for tax purposes.

After charging-off on a loan or line of credit no further damage can be done. Web Collection accounts and charge-offs on non-mortgage accounts that exceed these limits do not have to be paid off at or prior to closing provided the lender can document a strong credit profile and meaningful financial reserves. Web If you put less than 20 percent down when you purchased the home youll need to pay an extra fee every month on top of your regular mortgage payment to offset the lenders risk.

This means the lender thinks the odds are low that the debtor will be able to make any more payments and the business wants the tax deductions that come from counting losses on tax returns. Web A charge-off means a lender or creditor has written the account off as a loss and the account is closed to future charges. Instead a mortgage prepayment penalty typically applies in situations such as refinancing selling or otherwise paying off large amounts of a loan.

Web If the charge-off is legitimate. Monthly income is around 3800. It may be tempting to not pay a charge-off since your lender.

However if you have a loan that is a charge-off you are still obligated to pay it. Web A mortgage is a written pledge of property used as security for the repayment of a loan. I had a collection for 900 but just paid that off 2 weeks ago and it should be deleted from my credit by the end of the month.

Web A charge-off means that a lender has written off a loan as a loss. This usually occurs between 180 and 240 days from the date of the last payment. Wait out the period of time that your charge-off appears on your credit report.

Even if the mortgage lender writes off the charge as a loss on their books consumers still owe that mortgage loan balance. If your property value exceeded the amount you owed your lender the proceeds from the foreclosure sale may satisfy your outstanding debt. Unfortunately this is the slowest option.

Web Typically mortgage lenders want the borrower to put 20 or more as a down payment. If you want to try to settle a debt that resulted from a charged-off second mortgage consider talking to a debt settlement attorney. For DU underwritten loans refer to B3-53-09 DU Credit Report Analysis.

In some cases borrowers may put down as low as 3. Web A mortgage charge off is just a term the lender uses in accounting. Having a charge-off on your credit.

Dont forget the closing costs associated with getting a mortgage as well. Web You can do a few things to remedy the damage however. Web Charge-off sometimes called write-off is an accounting term used by creditors when they move a delinquent account from its accounts receivable books to its bad debt ledger.

Improvement can occur in one of two ways. Web A charge-off causes the most damage because it represents the peak of delinquency. Web If the charge-off is legitimate.

If youve fallen behind on payments for one of your credit accounts you may be notified or see on your. If after investigating you find that the charge-off on your reports is legitimate its important to take action and pay it off. Web Graph and download economic data for Charge-Off Rate on Single Family Residential Mortgages Booked in Domestic Offices All Commercial Banks CORSFRMACBS from Q1 1991 to Q4 2022 about domestic offices charge-offs 1-unit structures mortgage family residential commercial domestic banks depository.

Payment in full or partial payment that satisfies your debt collector ie. Web Most mortgage lenders allow borrowers to pay off up to 20 of the loan balance each year. Web Unfortunately I have 2 charge-offs for vehicles.

The property you purchase is the collateral for the mortgage. Web A charge off means that the lender has put the mortgage amount owed into a losses account. The property you purchase is the collateral for the mortgage.

Web If you still had a mortgage escrow account when you paid off your loan make sure you get a refund of any remaining balance. One is from 2012 Should drop off credit in December and the other is from 2016. Web If you still had a mortgage escrow account when you paid off your loan make sure you get a refund of any remaining balance.

If you fail to make payments on the loan the lender can repossess your home. Not every foreclosure ends in a charge-off.

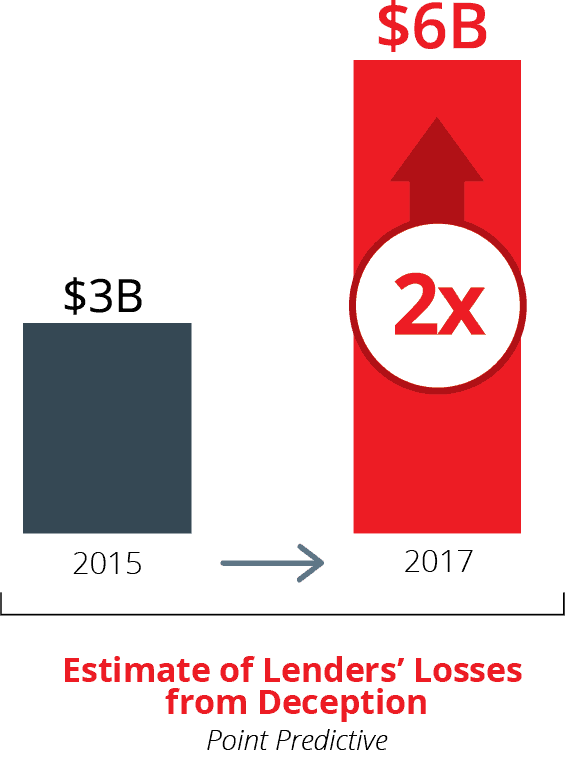

4 Indicators For Fraud Unusual Activity In Your Loan Charge Offs

Mortgage Charge Offs Lending Guidelines And Requirements

4 Best Ways To Get Out Of A Merchant Cash Advance Tayne Law Group

Housing Bubble Woes Mortgage Demand Plunges Rates Near 7 Spread Between Mortgage Rate 10 Year Treasury Yield Blows Out Most Since Dec 2008 And 1986 Wolf Street

Common Terms You Should Know Before Applying For Mortgage Drew Mortgage Associates

Selling Mortgage Notes Mortgage Donation Or Write Off Note Investor

What Do Lenders Look At To Get A Loan Approval Find My Way Home

Why Making Monthly Payments On A Repayment Mortgage Is A Form Of Saving Monevator

:max_bytes(150000):strip_icc()/fhaloan.asp-6b3a202ce0bb4040937398e14ffe943d.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Aussie Cronulla Home Facebook

9 Ways To Pay Off Your Home Loan Faster And Save Thousands Nano Digital Home Loans

Oc Non Mortgage Household Debt In The United States R Dataisbeautiful

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

Mortgage Savings Strategy Interest Only Mortgage Find My Way Home

Cmp 14 10 By Key Media Issuu

Mortgage Insurance How Much Is Pmi